The Effingham County Board of Education gave final approval Thursday to its fiscal year 2013 budget, reluctantly including a millage rate increase and a nearly $2 million transfer of education special purpose local option sales tax funds to balance the budget.

“Somebody’s gotta do it, so I may as well start,” school board vice chairman Troy Alford said as he made the motion to adopt the budget.

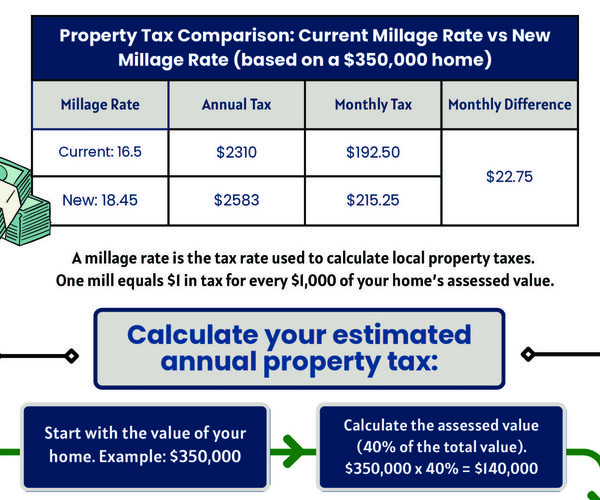

The board unanimously approved an $80,988,146 budget and a 16.897 millage rate for the coming fiscal year, which begins July 1. The budget decreased by nearly $2 million from last year, while the millage rate rose after remaining constant at 15.333 for the past three years.

Nonetheless, the school board faced a budget deficit due to millions of dollars in state funding cuts and reductions in local property tax collections. To offset the shortfall, the board approved transferring $1.9 million from the current ESPLOST, which expires June 30.

“I’m very proud to say our budget does balance without any calendar reduction days or furlough days,” Superintendent Randy Shearouse said. “These are tough times, but we’re moving forward and providing, I think, a workable budget.”

State law allows sales tax funds to be used toward the budget as long as a school district has completed the projects in its SPLOST plan and does not have any outstanding debt on a building or bond. Last year, the school board used federal dollars and money from its general fund to meet its budget needs.

Board member Mose Mock voiced concern that the school district will “start out next year behind the eight ball” with $1.9 million less in its coffers and will need to “pray for the state to give us some more” funding than in recent years.

“This (SPLOST fund transfer) is something that worked for us this year. We won’t have it next year,” Shearouse said. “Our hopes are that the state will increase funding. If they don’t, then we’ll have to find some reductions in our budget, for sure.”

Shearouse reiterated that the millage rate increase will not generate any additional revenue for the school system since Effingham County’s tax digest decreased by 9 percent, or $138 million, from last year. School officials expect the 16.897 millage rate to produce $25,120,120 in school tax revenue, an $830,000 decrease from just two years ago.

Shearouse said that without the $1.9 million in SPLOST funds, the school board would have needed to increase the millage rate an additional 1.293, to 18.19 mills, to balance the budget. Three-quarters of the county’s 27,027 parcels of property decreased in value this year, including nearly 17,000 that declined by 10 percent or more.

“I know that causes difficulty among everyone who depends on millage to survive,” Shearouse said. “From a school board perspective, those 16,920 parcels should pay the same or less in taxes.”

Along with the decline in local school tax revenue, the state has cut millions of dollars in funding to Effingham County – totaling more than $42 million since 2003. Also, the school district had to budget for rising expenses such as higher prices on diesel fuel for school buses and escalating insurance premiums for non-certified employees, such as custodians and bus drivers.

Despite the tough budget times, Shearouse said “the Effingham County School System continues to provide a great return on investment.” He pointed to the improvements students made this year on standardized tests such as the Criterion-Referenced Competency Test (CRCT) and the Fifth-Grade Writing Assessment.

“We are a low-wealth system and we don’t spend very much per student, yet we have great results. Our test scores continue to go up,” Shearouse said.