RINCON, Ga. — Amy Carter knew buying her first home in Effingham County would require compromises.

Fresh off a divorce, she was leaving a $360,000 home in Pooler — one her former husband owned — and stepping into the housing market on her own for the first time. This time, the mortgage would be in her name only.

Carter, a service coordinator for a mechanical contractor earning about $65,000 a year, moved with her 17-year-old son, Noah, and four German shepherds. Although she had equity from the Pooler home to put toward a down payment, she quickly realized how limited her options would be in the price range she could realistically afford.

“I knew I wasn’t going to get what I had before,” Carter said. “I just needed something safe, affordable and in the right school district for my son.”

She spent about three months viewing roughly 15 homes across Effingham County, with a firm budget of $250,000 to $260,000 and one non-negotiable requirement: Noah had to attend Effingham County High School.

When a ranch-style house in the Shadowbrook neighborhood of Springfield hit the market, she acted quickly. Listed on a Thursday, she had made an offer by Friday.

Built in 2013, the 1,373-square-foot home has four bedrooms, two baths and sits on a fenced three-eighths-acre lot. The price was $247,000 — well below what she had left behind.

“It was move-in ready, which mattered,” Carter said. “But I had to lower my expectations — linoleum floors instead of hardwood, standard countertops instead of marble.”

“There weren’t many single-family homes in that price range,” she added. “Once you find one that meets most of your requirements, you have to jump.”

Carter’s experience reflects a growing reality across Effingham County, where affordability — more than inventory alone — is shaping buyer behavior, development patterns and policy decisions.

A countywide challenge

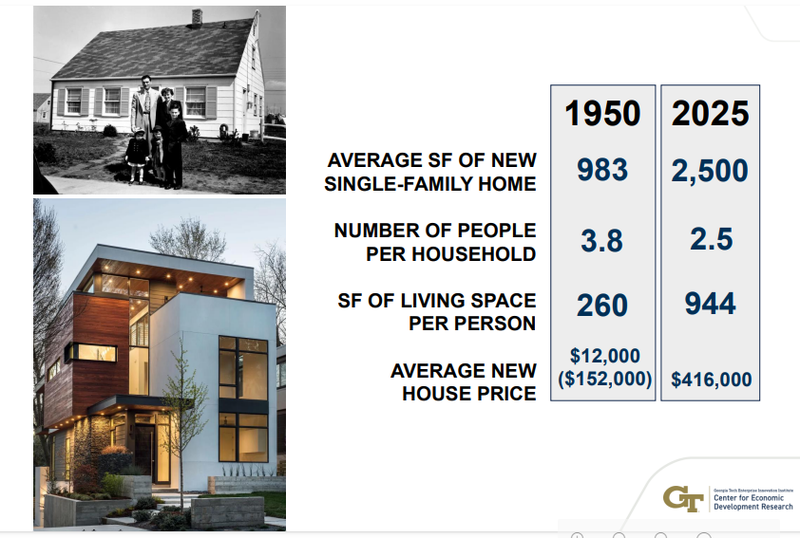

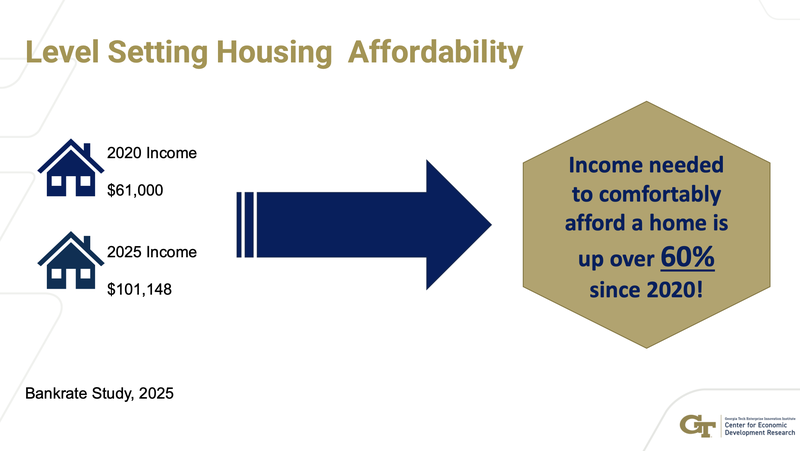

Betsy McGriff, project manager for Georgia Tech’s Center for Economic Development Research, told an Effingham County Chamber of Commerce meeting that ensuring attainable housing across income levels is one of the county’s most pressing challenges.

“If you’re just starting your career, it’s tough to find a place to live that fits your budget,” McGriff said. “That affects workforce recruitment, retention and ultimately the community’s future.”

Georgia Tech data show a widening gap between incomes and housing costs. Median household income is about $92,000 for homeowners, compared with roughly $53,000 for renters. Median home prices now exceed $340,000.

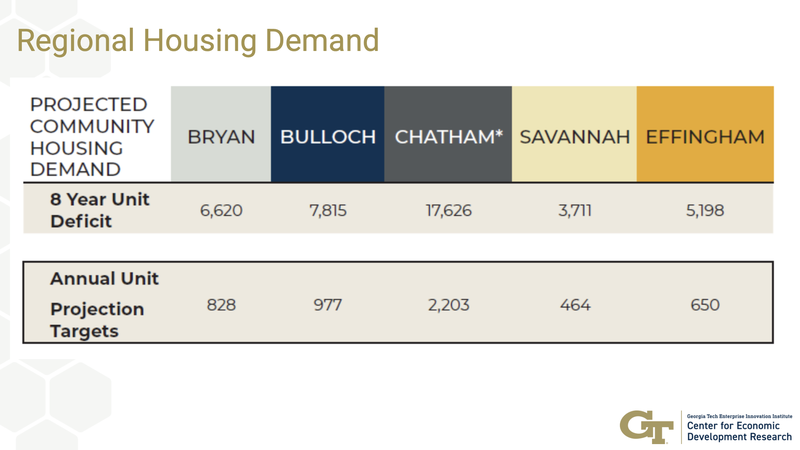

To keep pace with projected job growth tied to industrial expansion — including Hyundai suppliers — the county will need about 5,200 new homes over the next eight years, or roughly 650 per year, McGriff said.

But simply building more homes will not solve the problem if most remain priced beyond the reach of first-time buyers and essential workers.

“Future growth has to include smaller starter homes and more multi-family options,” McGriff said, “especially for nurses, teachers and tradespeople.”

Springfield’s approach

In Springfield, city leaders are rethinking zoning rules, infrastructure planning and the types of developments the city encourages.

Erin Phillips, Springfield’s planning and development director, said most vacant residential land remains zoned for detached single-family homes. Higher-density housing types such as townhomes and apartments require additional approvals, more pre-planning and expanded infrastructure — all of which drive up costs.

To address those constraints, Springfield has revised zoning districts to reflect current codes and housing needs, encouraged developers to incorporate smaller lots and pockets of higher density within subdivisions, and focused infrastructure investments on areas already near existing water and sewer lines.

City Manager Lauren Eargle said Springfield is advancing a wastewater treatment plant upgrade that will support roughly 3,300 residential units, with future expansion options. The upgraded plant is expected to come online in 2028, and a Lot Creation Application process will begin in mid-2026 for properties seeking to move forward before additional sewer capacity becomes available.

Rincon’s shift

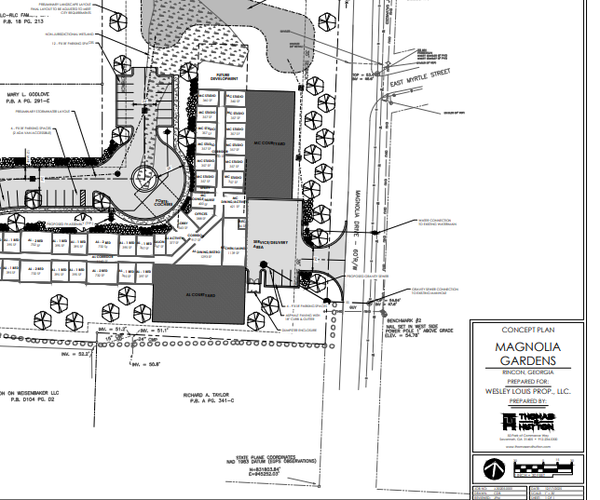

In Rincon, officials are beginning to introduce more diverse housing types while pausing to reassess the pace and form of future residential growth.

Planning Director Teri Lewis said three townhome developments have recently been approved and are now moving through construction — a notable shift in a city long dominated by detached single-family homes.

Parkview, behind the Sonic restaurant off State Route 21, is nearly complete, with city inspectors already conducting certificate-of-occupancy checks. A second townhome project off Blue Jay Road has finished site preparation and is expected to begin vertical construction within about a month. A third development, just past the railroad tracks on State Route 21 across from the Coastal Trade Center warehouses, has completed pre-construction work, with site preparation scheduled to begin after demolition of an existing house.

“These are townhomes, not apartments,” Lewis emphasized, noting that Rincon has not had any recent apartment projects come online.

Looking ahead, Rincon is planning for larger-scale growth tied to the Lexington Avenue extension. The proposed annexation could support roughly 400 new homes, significantly increasing the city’s housing capacity.

Lewis said Rincon’s updated Unified Development Ordinance (UDO), adopted in March 2024, removed minimum house-size requirements and allows duplexes in single-family districts. Townhomes and apartments remain permitted in appropriate zoning areas, though not within single-family districts.

At its Jan. 27 meeting, Rincon City Council approved a moratorium on new residential development until June, citing the need to expand the city’s wastewater treatment capacity and review its UDO. The moratorium does not affect projects that have already received approval.

Guyton’s constraints

In Guyton, city leaders say efforts to preserve affordability focus largely on limiting added costs rather than rapidly expanding housing types.

City Manager Bill Lindsey said the city rolled back the millage rate in 2025 to 2.14 mills, keeping property taxes as low as possible. Impact fees and permit fees have also been held steady to prevent regulatory costs from contributing to higher home prices.

“We’re trying to make sure city taxes and fees aren’t driving prices higher,” Lindsey said.

Several single-family developments are in various stages of planning or construction, though wastewater capacity remains a limiting factor.

Guyton Station, south of the traffic circle on Georgia Highway 17, completed Phase I with 45 homes. Phases II and III, which would add 66 more homes, are on hold after the city reached maximum wastewater treatment capacity.

Lindsey said the city is working with the Georgia Environmental Protection Division to temporarily continue using two spray fields slated for closure due to floodplain concerns. Continued use would provide enough capacity to complete the remaining phases.

Alexander Farms, a proposed 182-home development on Gracen Road, is expected to receive final plat approval for Phase I — 82 homes — at the City Council’s Feb. 10 meeting. Phase II would add another 100 homes extending to Old Louisville Road. Because of wastewater constraints, the project will rely on septic systems while receiving city water service.

Two additional projects are in earlier planning stages: a proposed 60-home subdivision by SB Homes at Old Louisville Road and Georgia Highway 119, and a 15-home development along Fourth Street Extension.

Guyton has also contracted with The Berkeley Group to conduct a comprehensive review of zoning, subdivision regulations, historic preservation policies and the city’s comprehensive plan, with recommendations expected later this year and into 2027.

County action

Effingham County is also taking steps to expand housing options, particularly for first-time buyers and essential workers, county manager Tim Callanan said.

County leaders recently revamped the R5 zoning district, allowing developers to integrate up to 20% multi-family units within predominantly single-family subdivisions. Those can include townhomes, duplexes and narrow-lot homes — smaller single-family units designed to be more attainable while maintaining a detached-home appearance. All developments must preserve at least 25% open space.

To increase rental options, the county has approved several apartment projects. “The Greens” at State Route 21 and McCall Road will offer 285 units. A second complex near Blue Jay Road and State Route 17 will add roughly 200 units. A third project behind The Greens will include about 300 units, and another 70 units are under construction on Goshen Road — nearly 800 units total.

The affordability squeeze

Callanan said affordability pressures are reshaping both buyer behavior and construction activity. New home permits have fallen to about 288 per year — roughly half the rate seen two years ago — as builders respond to softer demand and buyers’ shrinking purchasing power.

Realtors and real estate agents describe a market that is challenging but increasingly predictable.

Steffany Farmer, a Better Homes & Gardens real estate agent with 32 years of experience in Chatham, Effingham and Bryan counties, said most sales over the past six months in Effingham County have fallen between $250,000 and $325,000. About 89% were single-family homes, with 80 to 84 active listings in that range — roughly a three-to-five month supply. Homes priced under $250,000 remain limited, with only 11 available countywide.

Even when buyers find a home, Farmer said the total cost often comes as a shock.

“Almost everyone — not just first-time buyers — is struggling with increased housing costs, down payments, interest rates and closing costs,” she said. “If you don’t have a dual income, or you have kids, that’s a big chunk of change.”

Closing costs typically run about 3% of the loan amount, along with rising homeowners insurance premiums. Buyers also face inspection costs — about $425 for a general inspection — plus optional inspections for HVAC systems ($85), roofs ($250) and septic tanks, along with appraisals around $650. Together, those expenses can approach $2,000 before moving in.

Julie Hales, a longtime Effingham County Realtor with Next Move Real Estate, said pricing, interest rates and closing costs are the biggest surprises for buyers.

Higher interest rates have intensified the pressure. Callanan said a $350,000 home purchased three years ago at a 3% interest rate would now cost about $690 more per month at today’s rate of roughly 6.25%.

“That difference alone can knock a lot of buyers out of the market,” he said.

Still, first-time buyers do have options. Carmen Cribbs, a broker with Next Move Real Estate, said federal programs such as USDA rural development loans and certain Fannie Mae products allow buyers to enter the market with little or no down payment and no private mortgage insurance. USDA loans are available throughout Effingham County, with income limits for a family of four around $95,000, depending on household size.

“The beauty of the USDA program is that it removes one of the biggest barriers — the down payment,” Cribbs said.

Farmer added that rental options remain limited, with only 12 homes in the county currently renting for $2,000 or less.

Coming full circle

For Carter, the numbers ultimately worked — narrowly.

She found a home by acting quickly and compromising on features she once took for granted, a calculation many buyers in Effingham County now face.

“There weren’t many single-family homes in my price range,” she said. “Once you find one that meets most of your requirements, you have to jump.”

As the county and its cities adapt policies and projects to improve affordability, Carter’s experience highlights a growing challenge: navigating a housing market where cost, not scarcity alone, determines who can call Effingham home.